The Auscap Long Short Australian Equities Fund has been awarded Best Australian Long Short Equities Fund in the Finance Monthly Global Awards 2015. We are humbled to accept the award and would like to thank Finance Monthly. Below is a link to ... Read more

A Buffet(t) of Business Culture, Brands & Buybacks

June Newsletter | Last month we discussed our trip to the 50th Berkshire Hathaway Annual General Meeting. In this edition we continues with a few more select quotes from the event. ... Read more

There’s Something About Warren

May Newsletter | In this edition we highlight a few of the insights we gleaned from attending the 50th Annual General Meeting of Berkshire Hathaway in Omaha, Nebraska. ... Read more

Auscap Awarded The Investors Choice Awards Australia Equity Long/Short Fund of 2014

The Auscap Long Short Australian Equities Fund has been named the winner of the Australia Equity Long/Short Fund of 2014, by The Investors Choice Awards. The Auscap Team are excited and humbled to have received the award. It has been another ... Read more

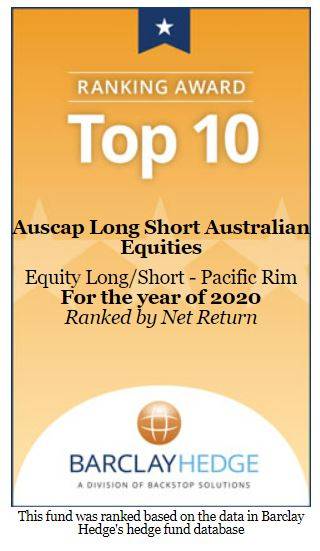

Auscap Awarded Best Long Short Equities Hedge Fund – Australia, International Hedge Fund Awards 2015

The Auscap Long Short Australian Equities Fund has been named the winner of the Best Long Short Equities Hedge Fund – Australia, by The International Hedge Fund Awards 2015, sponsored by BarclayHedge. The Auscap Team are excited and humbled to ... Read more

Why The Big Iron Ore Producers Face The Ultimate Prisoners’ Dilemma

November Newsletter | Why have the big iron ore producers continued to increase supply despite the obvious effect on price? In our latest newsletter we look at game theory for answers and conclude that despite the likelihood of lower profits, the big ... Read more

Is Now A Good Time To Buy Equities?

August Newsletter | Is now a good time to buy equities? It's the number one question asked of finance professionals. In our August newsletter we provide our view on the perennial question all investors would like an answer to. We look at this in the ... Read more