March Newsletter | Is the power of anchoring influencing your investment decision making? Anchoring in finance terms refers to basing investment decisions on previous known facts or stock prices, even if they’re not relevant to assessing value. It is incredibly difficult to avoid and can be hazardous. Presented with a constant stream of prices that should have some relationship to the value of an asset, investors face the risk of giving these prices more meaning than they deserve. To use iron ore as an example, the facts around supply / demand dynamics have led to widespread bearishness amongst those analysing the iron ore market, yet price forecasts don’t reflect this view. We would suggest that were it not for the recent price history of iron ore, the price expectations from the bears would be considerably lower. To us, focusing too much on past price action can be to the detriment of the investor.

- About

- Funds

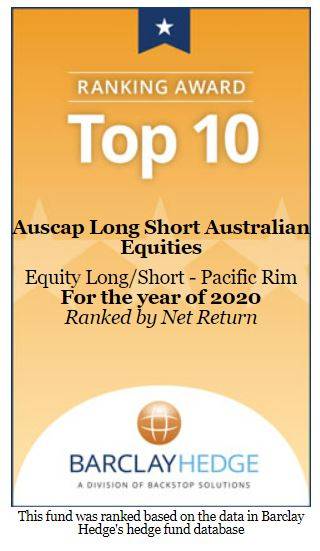

- Auscap Long Short Australian Equities Fund

- Auscap Ex-20 Australian Equities Fund

- Auscap Investor Webinar – November 2023 – Introducing The Auscap Ex-20 Australian Equities Fund

- Fund Overview

- Fund Performance – Auscap Ex-20

- Investor Forms

- How To Apply Ex20

- Product Disclosure Statement

- PDS Updates and Disclosure

- Platform Availability

- Unit Prices & Other Information

- Target Market Determination

- News

- Community Support

- Careers

- Contact

Lonsec Disclaimer

The Lonsec Rating (assigned October 2018) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445. The Rating is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product. Past performance information is for illustrative purposes only and is not indicative of future performance. It is not a recommendation to purchase, sell or hold Auscap Asset Management Limited’s product, and you should seek independent financial advice before investing in this product. The Rating is subject to change without notice and Lonsec assumes no obligation to update the relevant document following publication. Lonsec receives a fee from the Fund Manager for researching the product using comprehensive and objective criteria.

For further information regarding Lonsec’s Ratings methodology, please refer to Lonsec’s website at: http://www.beyond.lonsec.com.au/intelligence/lonsec-ratings

Auscap Asset Management Limited, its directors and employees do not accept any liability for the results of any actions taken or not taken on the basis of information contained in the Lonsec Rating, or for any errors or omissions.

Important Information

This document does not constitute an offer of units in the Auscap Long Short Australian Equities Fund (Fund) in any jurisdiction other than Australia or New Zealand (or in jurisdictions where it is lawful to make such an offer). Applications for units in the Fund from residents outside of Australia and New Zealand may not be accepted.

By clicking on the “I Confirm” button below you are confirming that you are a resident of Australia or New Zealand (or that you are acting on behalf of a person who is a resident in one of those jurisdictions).

Please note that the Application Form included with this PDS should not be completed in a Google Chrome Browser. We recommend that you save this PDS to your computer and open it using Adobe Acrobat Reader. This will ensure that the interactive fields in the Application Form section work correctly. Thank you.

Lonsec Disclaimer

The Lonsec Rating (assigned October 2018) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445. The Rating is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product. Past performance information is for illustrative purposes only and is not indicative of future performance. It is not a recommendation to purchase, sell or hold Auscap Asset Management Limited’s product, and you should seek independent financial advice before investing in this product. The Rating is subject to change without notice and Lonsec assumes no obligation to update the relevant document following publication. Lonsec receives a fee from the Fund Manager for researching the product using comprehensive and objective criteria.

For further information regarding Lonsec’s Ratings methodology, please refer to Lonsec’s website at: http://www.beyond.lonsec.com.au/intelligence/lonsec-ratings

Auscap Asset Management Limited, its directors and employees do not accept any liability for the results of any actions taken or not taken on the basis of information contained in the Lonsec Rating, or for any errors or omissions.

Shortcuts

About us

Auscap funds

Auscap Asset Management

ACN 158 929 143

AFSL 428014

© Auscap Asset Management Limited 2024 | Terms of Use | Privacy Policy | Complaints | Website by Pixel Palace.